oklahoma franchise tax instructions

The rules legislation and. Go to the Oklahoma Taxpayer Access Point OkTAP login page.

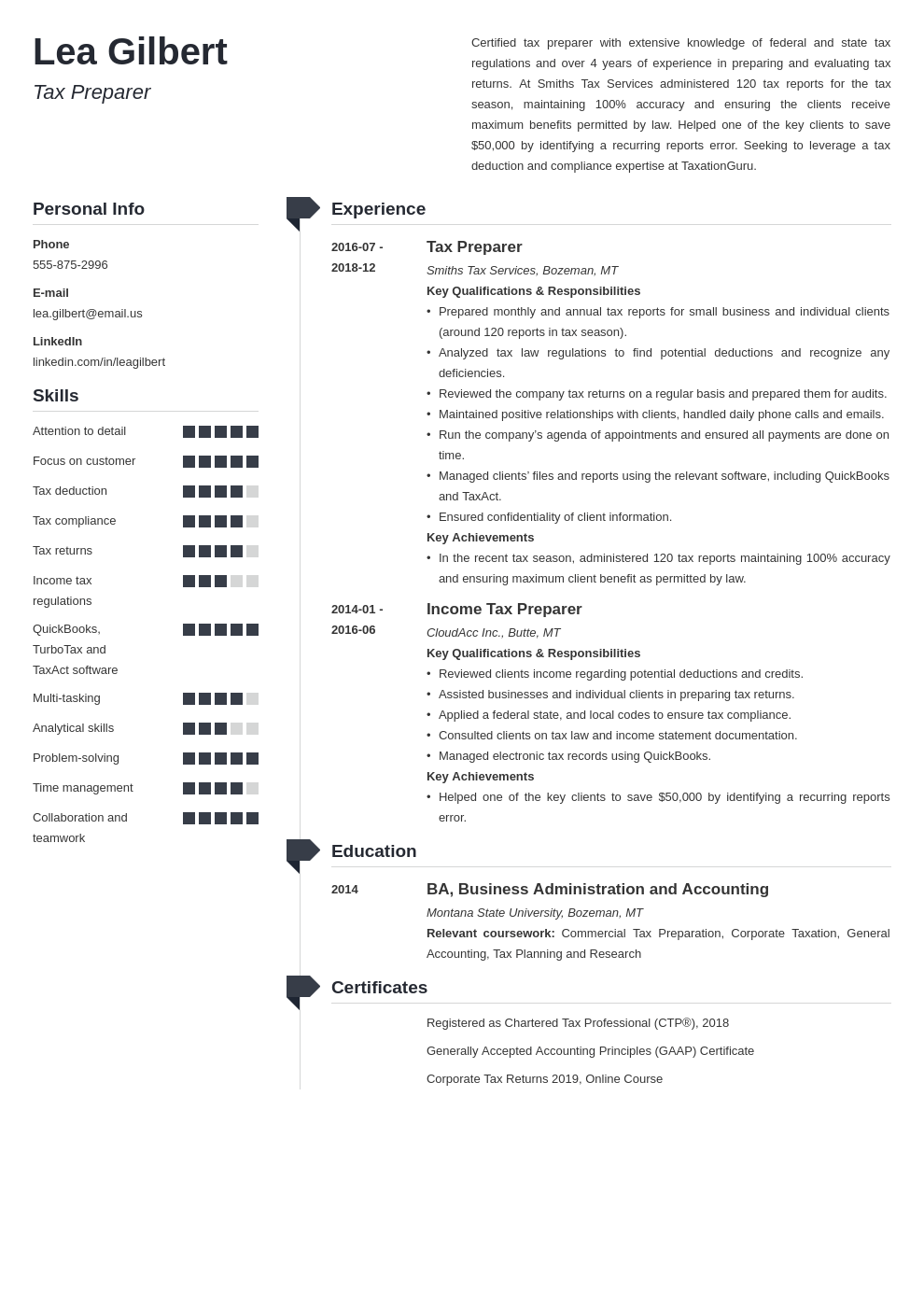

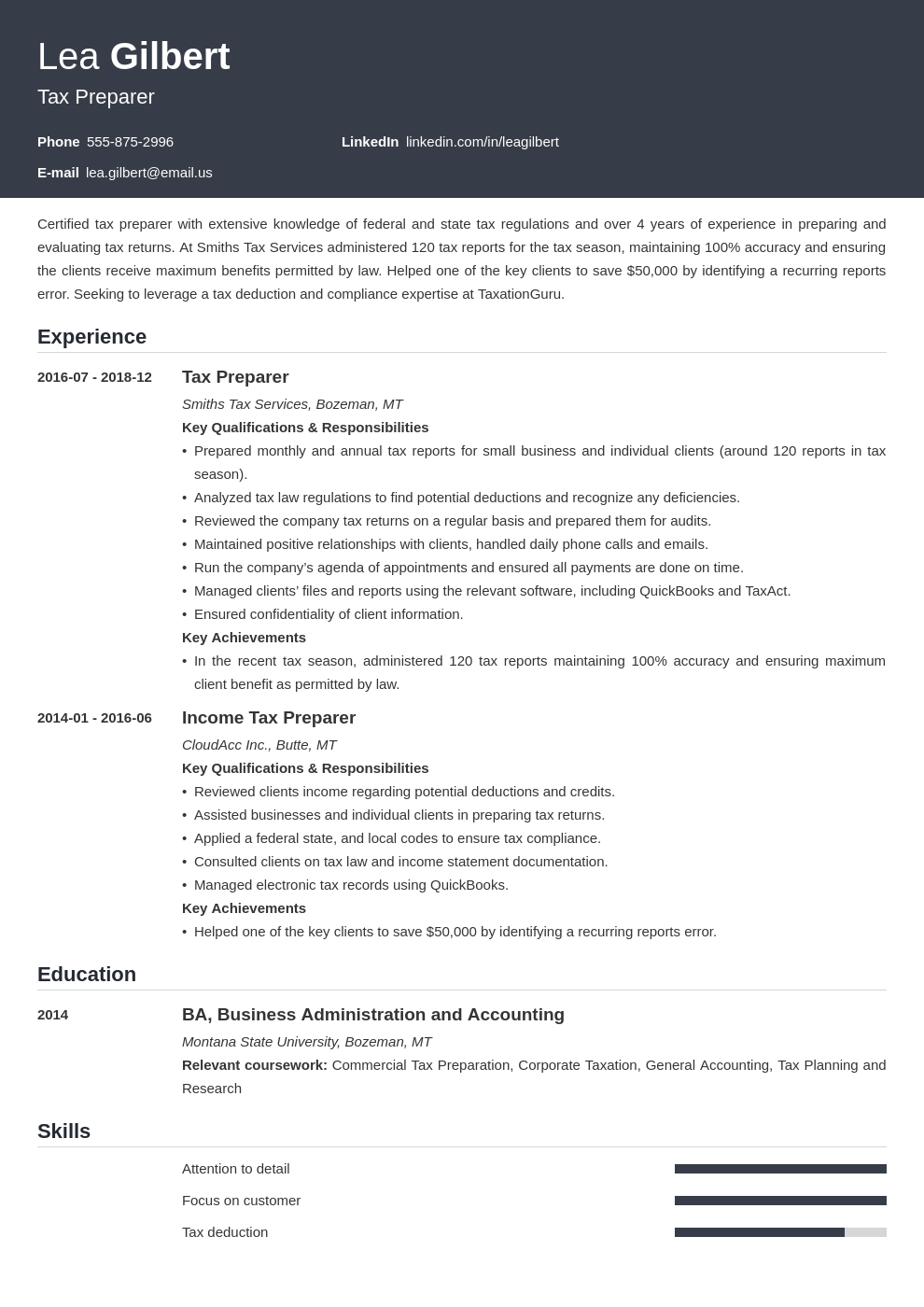

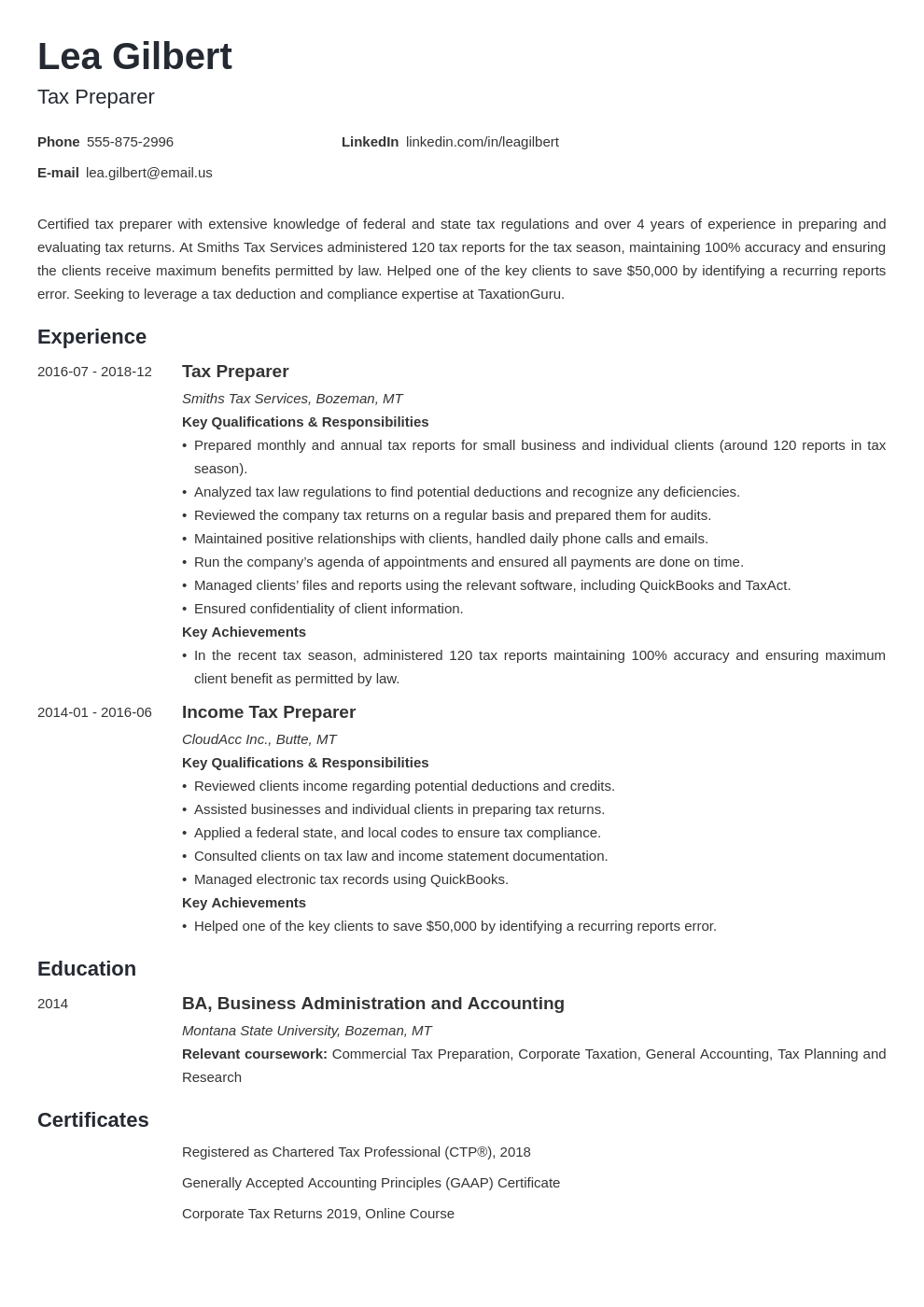

Tax Preparer Resume Sample Writing Guide 20 Tips

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

. But Oklahoma does have laws. Oklahoma franchise tax is due and payable each year on July 1. Oklahoma is classified as a non-registration state because it has no laws requiring franchisors to register with the state before offering or selling their franchise.

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. Mine the amount of franchise tax due. Ad Talk to a 1-800Accountant Small Business Tax expert.

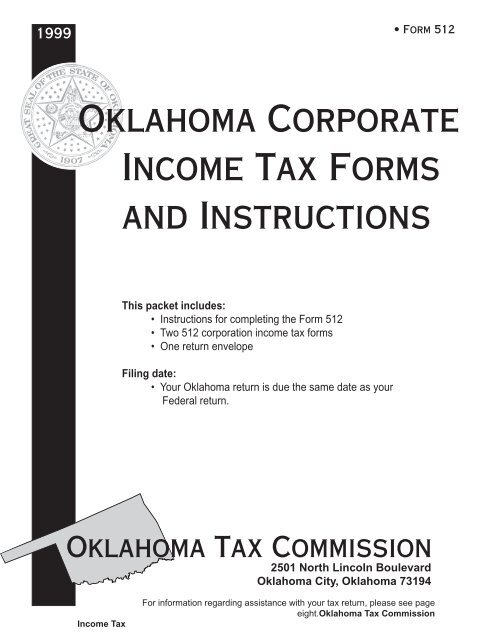

Specific Line Instructions Line 1 Tax Enter the amount computed from your worksheet. Instructions for completing the Form 512 512 corporation. Lets say you own a cute little diner in.

We have the experience and knowledge to help you with whatever questions you have. For a corporation that has elected to change its filing period to match its fiscal year the franchise. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or.

When is franchise tax due. Oklahoma franchise tax instructions. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year.

If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax. The amount must be either zero 0 or the Line 2 Registered Agent Fee If your corporation. Return due date is January 1 2008 or later - If your capital was 200000 or less the minimum tax is zero.

To file your Annual Franchise Tax Online. All organizations falling within the purview of the Franchise Tax Code. Enter your username and password.

Oklahoma Annual Franchise Tax. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax. OKLAHOMA BUSINESS INCENTIVES AND TAX GUIDE PUBLISHED JUNE 2022 Welcome to the 2022 Oklahoma Business Incentives and Tax Information Guide.

Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax.

Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains. When submitting the Franchise Tax Return foreign corporations must pay a 100. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Get the tax answers you need. Ad Access Tax Forms.

Account Id And Letter Id Locations Washington Department Of Revenue

Account Id And Letter Id Locations Washington Department Of Revenue

Oklahoma Corporate Income Tax Forms And Instructions

Will I Get Audited If I File An Amended Return H R Block

Tax Preparer Resume Sample Writing Guide 20 Tips

Oklahoma Corporate Income Tax Forms And Instructions

How Are Trusts Taxed Faqs Wealthspire

Oklahoma Corporate Income Tax Forms And Instructions

Special Power Of Attorney Form Elegant Instruction To Fill Oklahoma Special Power Of Attorney Power Of Attorney Form Power Of Attorney Attorneys

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Filing Taxes For Small Business With No Income Requirements

Tax Preparer Resume Sample Writing Guide 20 Tips

Free Divorce Financial Agreement Template Divorce Settlement Agreement Divorce Agreement Divorce Settlement